This blog is going to be very informative because in this blog we are going to share the complete process how to buy swap coins on Coinbase. Which would definitely help you to swap coins . The act of swapping cryptocurrency coins or tokens known as cryptocurrency trading. The idea sounds simple, but, if you have over 1,500 exclusive sorts of cryptos, it is able to get a touch complicated.

There is a constant expansion of the market, and every time a company feels ambitious, it adds another token to the mix. Besides bringing new value to the market, each of these tokens represents a potential investment opportunity as well. Knowing how to swap makes a big difference to some investors since this can determine their financial path.

It is often difficult for new traders to decide how to proceed when they are faced with an overwhelming collection of coins. One chain might have given them some tokens, but another chain may provide them with a better opportunity to make money. Many people still use the traditional conversion method here. Afterward, they would convert their crypto to fiat currency to buy the coin they desire. This approach still works, but it includes an extra step and you can pay a couple of transaction fees.

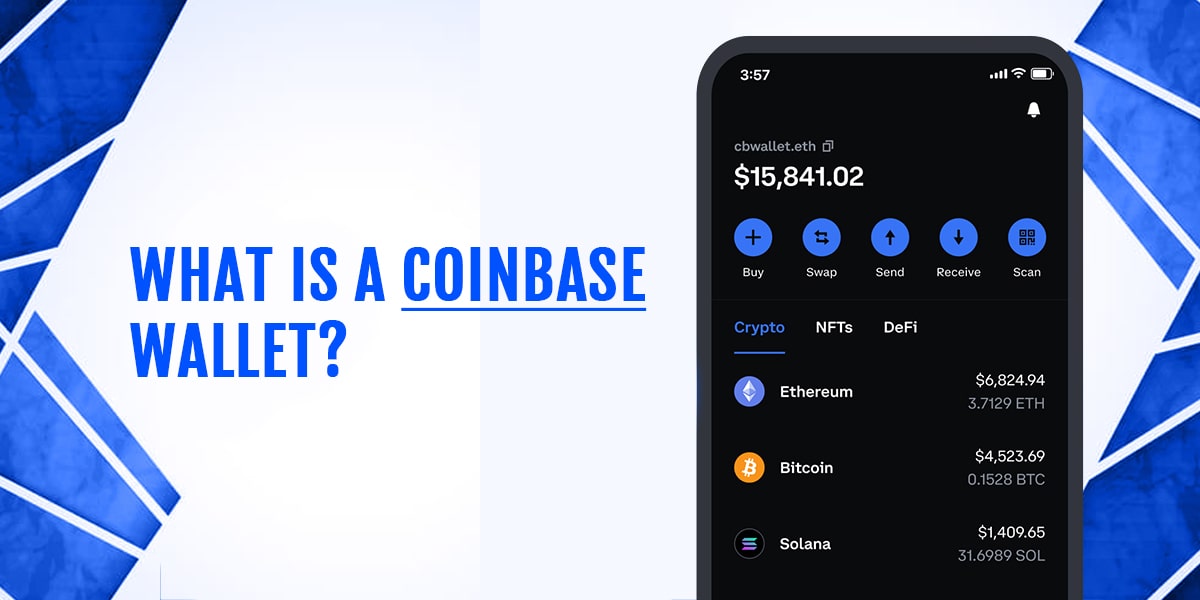

The Coinbase Wallet keeps your digital assets, digital collectibles, and cryptocurrencies secure. Unlike most cryptocurrency wallets, supports multi-currencies and is insure, an interesting feature. Two-factor authentication ensures that every user logging into your account can access your coins. While storing them in a secure location. You can manage your cryptocurrencies on the go with Coinbase Wallet, which is include with the program. CoinBase Wallet is available as a SaaS product and as a mobile app for Android and iOS.

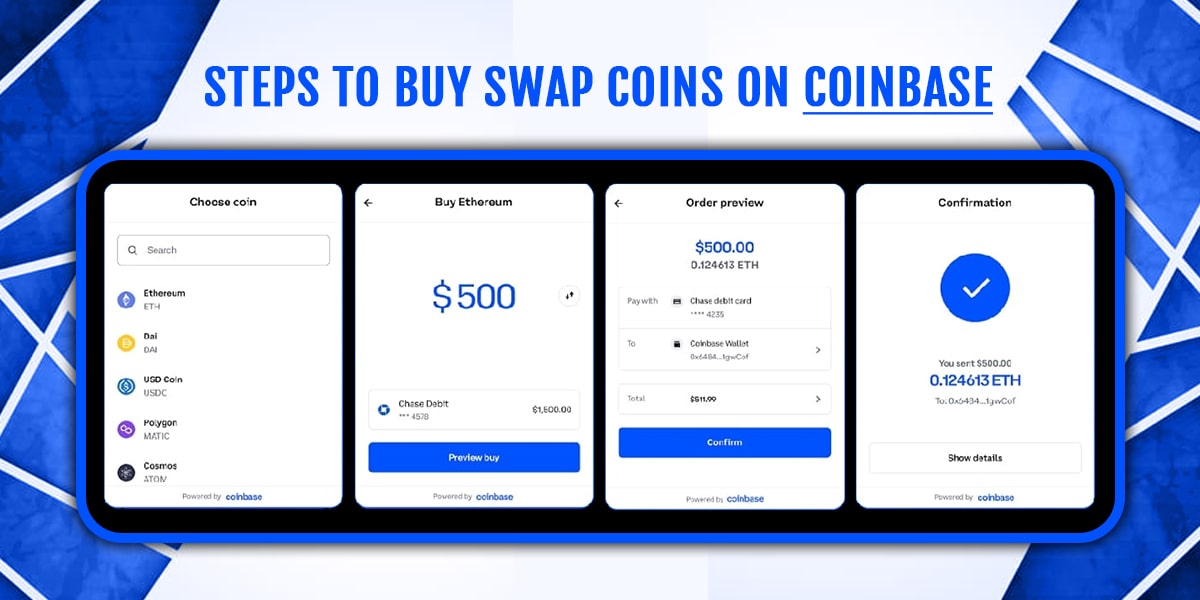

Step1:- Check Coinmarketcap to check the price of crypto that you want to swap

On CoinMarketCap, a list of compatible cryptocurrencies (also called market pairs) is available. Find Swap by searching for it on the site and clicking “Market” near the price chart. Using this view, you can see a list of all the places where swaps can be bought, including the currencies you can use. A second currency will appear under “Pairs” in addition to the shorthand for Swap, XWP. It is possible to purchase Swap with the second currency. If you would like to purchase XWP with the American Dollar, you will need to search for the XWP/USD pair.

Step2:- Log in to Your Coinbase Account

Now you have to log in to your Coinbase wallet to buy swap coins on Coinbase

Step3:- Buy Swap Coins On Coinbase

Platforms do things . Some structures are very smooth to use, others now no longer so much. The cryptocurrency with fiat foreign money like the U.S. Dollar can be extra handy than shopping cryptocurrency with every other cryptocurrency. Creating a crypto wallet that supports.

Swap is the first step, then buying the first cryptocurrency, and then using the second currency to buy Swap on the platform you choose. You can find guides on most platforms if you get stuck. It`s now no longer unusual for crypto fans to put up courses on Youtube, Twitter, and different social media websites in the event that they don’t.

-

Cryptocurrency trading can be made simple with token swaps. These platforms provide simple, versatile, and secure crypto-to-crypto trading gateways. A custodial and non-custodial platform can exchange data using these systems.

-

Data integrity may also benefit users because token swaps and related transactions are record on the blockchain.

-

The token transfer is also guaranteed to be atomic with atomic swaps. The possibility of cross-chain token. Swapping can also lead to greater interoperability among users. One of the most significant benefits of token swap smart contracts is that they may end the need for third-party tokens. Allowing for payment via escrow. Thus, trading cryptocurrencies can be a cheaper alternative by using token swapping.

Coinbase Wallet Transaction Fees

In addition to the spread, Coinbase costs a rate for cryptocurrency transactions on its website. This can include buying Bitcoin or exchanging Ethereum back into USD.

You can compare the spread to the commissions or trading fees. You might pay when investing using a brokerage account. Where the spread is the difference between the market price and the price you pay for Buy Swap Coins On Coinbase.

There are approximately 0.50% spreads on Coinbase’s crypto sales and purchases. They can fluctuate according to market conditions. Coinbase may charge a spread of up to 2.00% for cryptocurrency conversions — trading Bitcoin for Ethereum. For example — if market conditions are volatile. Converting your cryptocurrency coins to another cryptocurrency does not incur a Coinbase Fees.

Coinbase Fees are also subject to change based on your payment method, location, and other factors. They can be flat fees or percentages of your transaction, but will always be the greatest.

Here are some amazing advantages of Coinbase wallet that we would discuss.

-

This vendor provides access to some crypto-related applications and services. including exchanges, jobs, and more. This means that you are always able to conduct crypto-related business in a trusted and secure environment.

-

It is essential that you use a wallet that speaks the same language as those applications and marketplaces. MetaMask offers wide support for many applications and marketplaces. But you can connect your wallet with Coinbase Wallet, too.

-

A wide range of cryptocurrencies are available. Coinbase Wallet helps you manage your portfolio with crypto such as Bitcoin, Ethereum, and Litecoin. Ethereum’s ERC721 collectibles are also supported.

-

A decentralized change characteristic permits customers to exchange Ethereum. And based belongings without delay in the app. Whilst in-app crypto shopping for permits customers to buy belongings that aren’t Ethereum- or based .

Coinbase Security Feature:

- There is no federal regulation protecting cryptocurrency, unlike cash in a bank.

- According to Coinbase, 98% of its customers’ crypto is store offline in cold storage (2% is use to ease trading). Too to insurance, Coinbase also has a robust crypto holdings insurance policy. Experts claim that robust measures like this make a mainstream exchange like Coinbase worth paying extra fees.

- The coins you’ve invested in a crypto wallet will not be return to your wallet if a massive security breach occurs. Coinbase says in such a case “we will strive to make you whole.” It is possible, yet, that your funds will not be restore if the total losses exceed insurance recoveries.

- Additionally, the insurance policy does not cover losses resulting from unauthorized access to your personal account. In other words, if your identity has been stole or someone has managed to figure out your Coinbase account password and steal your wallet. It is unlikely that they will be able to retrieve it.

- Although Coinbase can make trades faster. It is not necessary for most people to store their money there (like they would not keep their cash in a conventional investment account). If you do hold cash on the exchange, it is pool with other users in one of three ways: in U.S. bank accounts, or in U.S. Treasury bonds. The method in which your cash is held is up to the FDIC’s current largest of $250,000. You have no control over how your cash is kept, but Coinbase says that bank accounts as cash are insure up to that amount.

- Authentication with two steps. Biometrics (such as fingerprints and face recognition), and encryption of data are also security measures. Maintain your own security by using strong passwords. Not repeating passwords across many accounts, enabling 2-factor authentication, and monitoring your accounts for unauthorized activity.