What Is PayPal?

PayPal is one of the leading digital money transfer platforms. It enables users to transfer funds quickly and without difficulty. If you use PayPal to send money to other individuals, first, you should send money to their account. Linking the bank account helps transfer money from bank account to PayPal easily. In addition, this digital platform is often used for regular payments.

It is effortless to link the bank account to the PayPal account with the help of a debit card. It enables business owners to pay themselves faster in the future and also pay workers or dealers within a few clicks. How do you add money to PayPal from your bank account? Keep reading this article to learn step-by-step instructions for transferring money from a bank to a PayPal account.

How To Link Bank Account To PayPal?

Establishing the connection between your bank account and your PayPal account before transferring funds would be best. Here are simple steps to link the bank account:

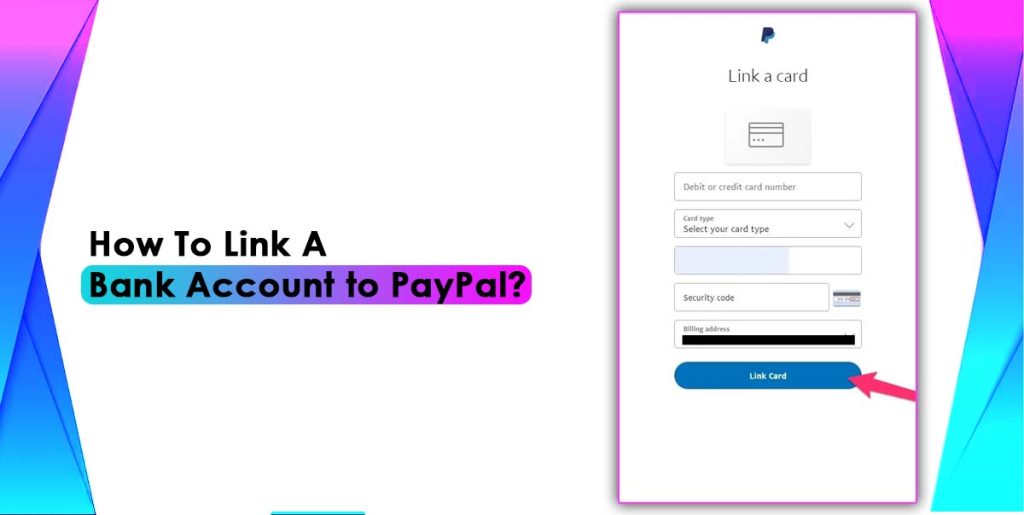

- First, you should visit the official portal of PayPal and log in to your account with credentials.

- Hit on the wallet tab from the top of the page and click on the link to a bank account option.

- Next, you must provide essential bank details such as name, routing number, account number, etc.

- After providing all details, PayPal will perform the verification process to make sure the accuracy of the bank account.

- It might send a code to the bank account statement for all deposits. You should follow the instructions from PayPal to finish the verification process successfully.

Steps To Transfer Money From Bank Account To PayPal

Once linked to the bank account to the PayPal account, you can transfer funds to PayPal. Let’s explore steps on how to transfer money from bank account to PayPal account:

- Open the PayPal app and sign in to the PayPal account with the proper username and password.

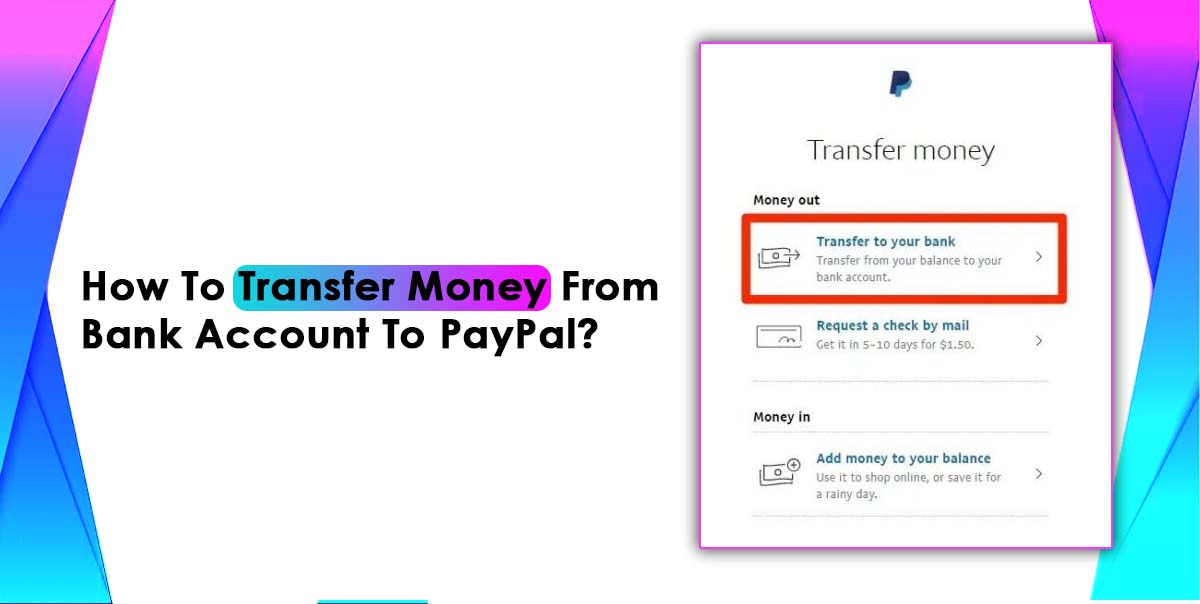

- Click on the transfer money option under the balance section on the home page.

- Hit on add money to your balance option on the next page. Click on it to continue.

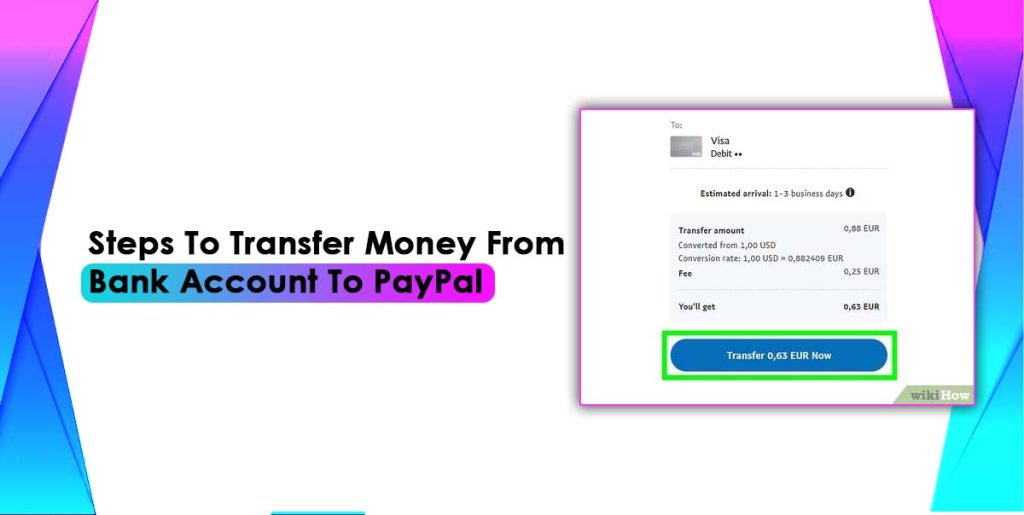

- Next, you can select the right bank account from the available options if you have various bank accounts linked to the PayPal account.

- Enter the amount you desire to transfer to a PayPay account from the bank account. It is important to note any extra fees associated with fund transfers.

- Double-check all transaction details such as bank account, transfer amount, etc. Hit on the Transfer option to start the process.

- Now, you can see the confirmation message in the PayPal app that shows the money transfer request has been received from other individuals.

PayPal funds typically appear in your account within three business days after processing, depending on the method of payment. In some cases, it may take up to five working days. If the person is concerned about the payment status, they can check the transaction details in their PayPal account.

Read Also: How To Transfer Cryptocurrency From Binance To Paypal?

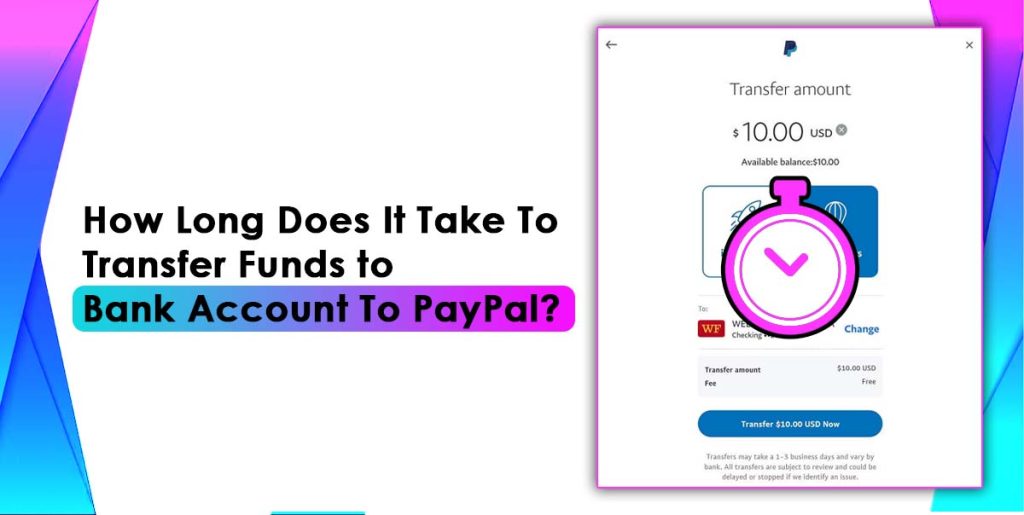

How Long Does It Take To Transfer Funds To PayPal From a Bank?

Based on your bank, the money will be added to your PayPal account within three or five business days. Many aspects can affect how faster funds appear in the PayPal account. It includes when you sent a request, the time of the day, how much funds you need to transfer, and others. In addition, the accurate processing time might vary based on the process and policy of the bank.

Avoid sending money during weekends, which affects the processing time. It is good to send requests before 7 PM for a quick approval. Before transferring money, you should check PayPal’s and the bank’s guidelines. It also helps you to send money instantly, effortlessly, and securely.

Additional Tips For Transferring Money to PayPal safely

Here are some tips for beginners that let them transfer funds to PayPal securely and smoothly.

- Before starting a transfer, you should verify sufficient funds in the bank account to transfer the money you desire without hassle.

- It is essential to check the transaction limit, which can differ according to the verification status and account type.

- PayPal platform charges fees are based on transfer types like instant transfers, international transfers, and others. Check the structure of PayPal to know the charges for fund transfers.

- Also, you should be aware of the processing time before transferring funds. It can vary on various aspects, such as weekends, holidays, bank processing times, etc. Therefore, you can transfer funds accordingly.

Considering these things will avoid disturbance during the money transfer process.

Conclusion:

This article will help transfer funds to the PayPal account. PayPal enables the user to send and receive money from anyone around the world easily. It helps the person save more time and money. Transferring money from bank account to my PayPal is flexible and convenient by following the earlier steps. Those who are looking to send funds internationally can use PayPal.