Venmo is a popular peer-to-peer payment service and digital wallet that allows individuals to send and receive money from friends and family. It operates primarily through a mobile app and is owned and operated by PayPal Holdings, Inc. Venmo makes it easy to split bills, share expenses, and make payments for various purposes in a convenient and social way. In this blog we’ve discussed How to Transfer Money From Venmo to Bank Account?. You need to follow our blog to transfer you money.

Simple Steps To Transfer Money From Venmo to Bank Account

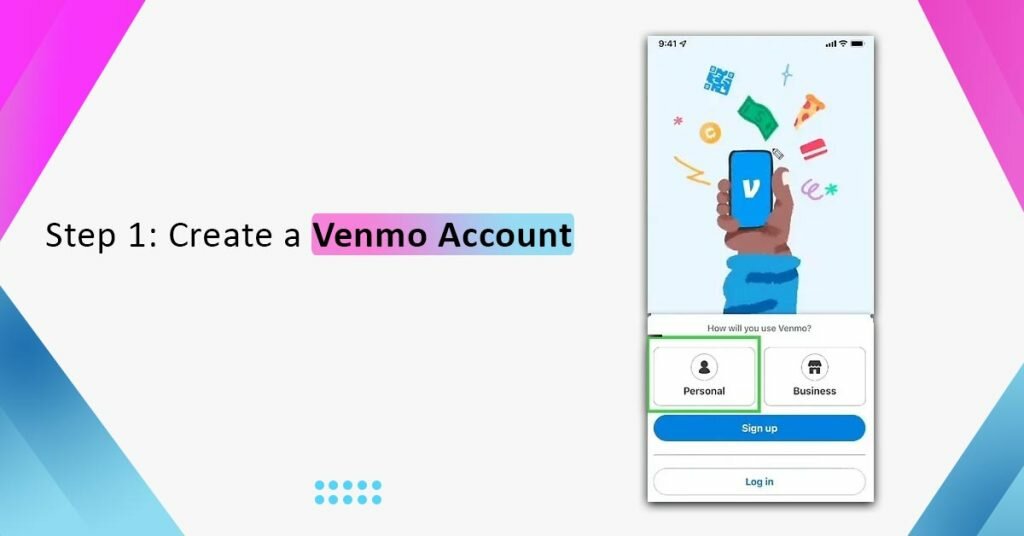

Step 1: Create a Venmo Account

- If you don’t already have a Venmo account, start by downloading the Venmo app from your mobile app store or visit the Venmo website.

- Sign up for a Venmo account by providing your email address, phone number, and creating a password.

- Complete the setup process by verifying your email and phone number.

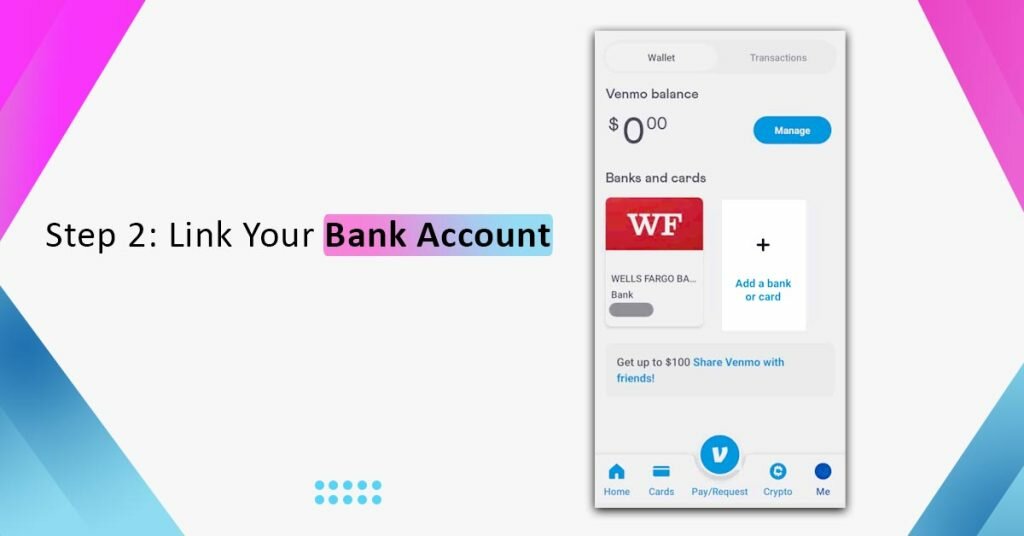

Step 2: Link Your Bank Account

- Once your Venmo account is set up, link your bank account to Venmo for easy transfers.

- In the Venmo app, go to your profile by tapping your profile picture.

- Choose “Settings” and select “Payment Methods.”

- Click on “Add a bank or card” and follow the prompts to add your bank account. You’ll need to provide your bank account details for this.

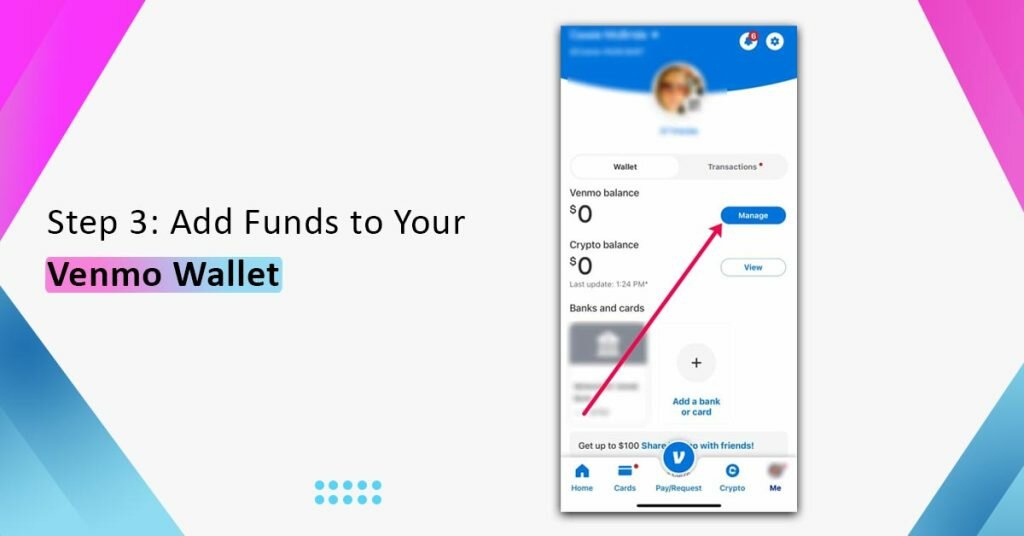

Step 3: Add Funds to Your Venmo Wallet

- To transfer money from Venmo to bank account, you need to have a balance in your Venmo wallet.

- You can add funds to your Venmo wallet by connecting your debit or credit card. Simply go to the “Settings” section, choose “Payment Methods,” and add your card.

- Alternatively, you can accumulate funds in your Venmo wallet by receiving payments from friends or family.

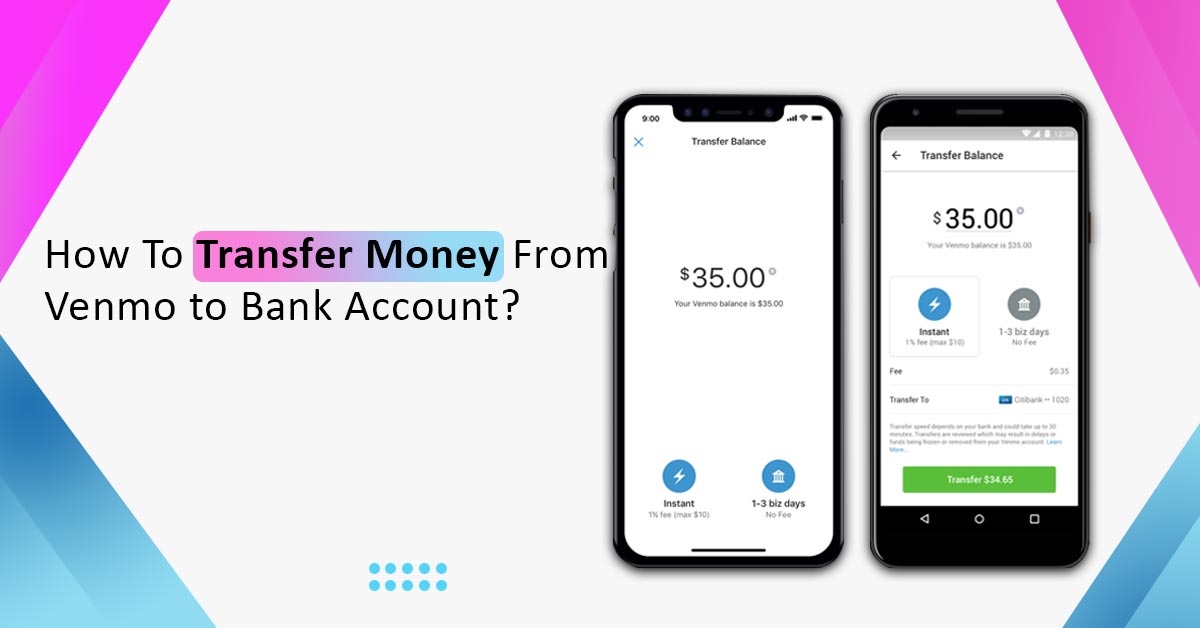

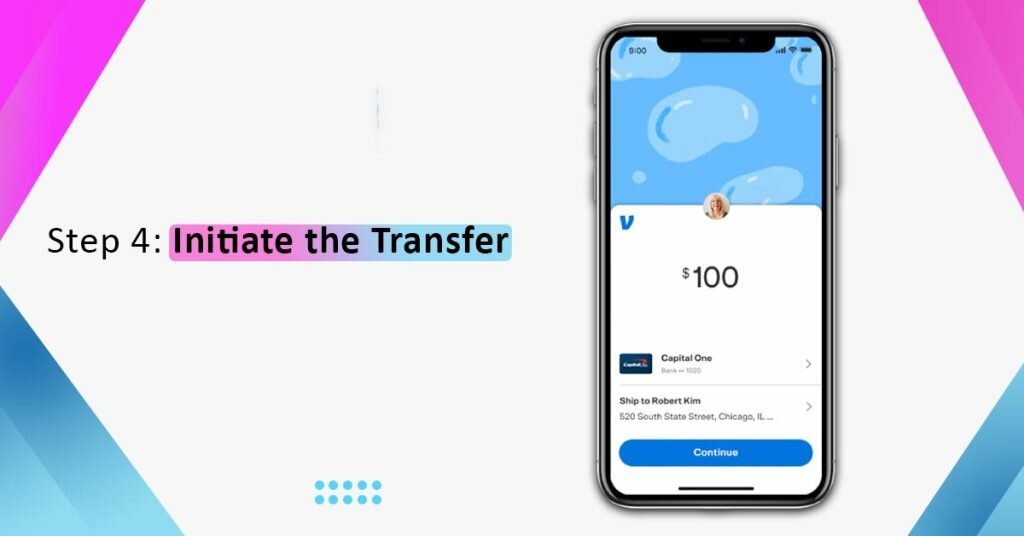

Step 4: Initiate the Transfer

- To transfer money to your bank account, open the Venmo app.

- Tap the menu button (usually represented by three horizontal lines) in the top left corner of the screen.

- From the menu, select “Transfer to Bank” or “Transfer Money” (the wording may vary slightly depending on the Venmo app version).

- Enter the amount you wish to transfer to your bank account.

- Choose the bank account you’ve linked earlier for the transfer.

- Double-check the information, then confirm the transfer.

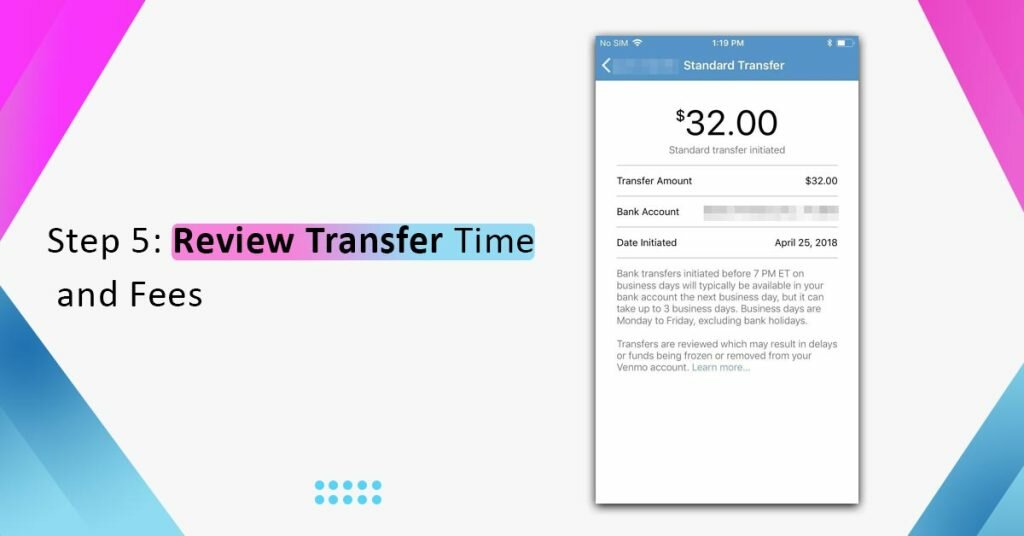

Step 5: Review Transfer Time and Fees

- After confirming the transfer, be aware that it may take 1-3 business days for the funds to appear in your bank account. Venmo may also charge a small fee for instant transfers.

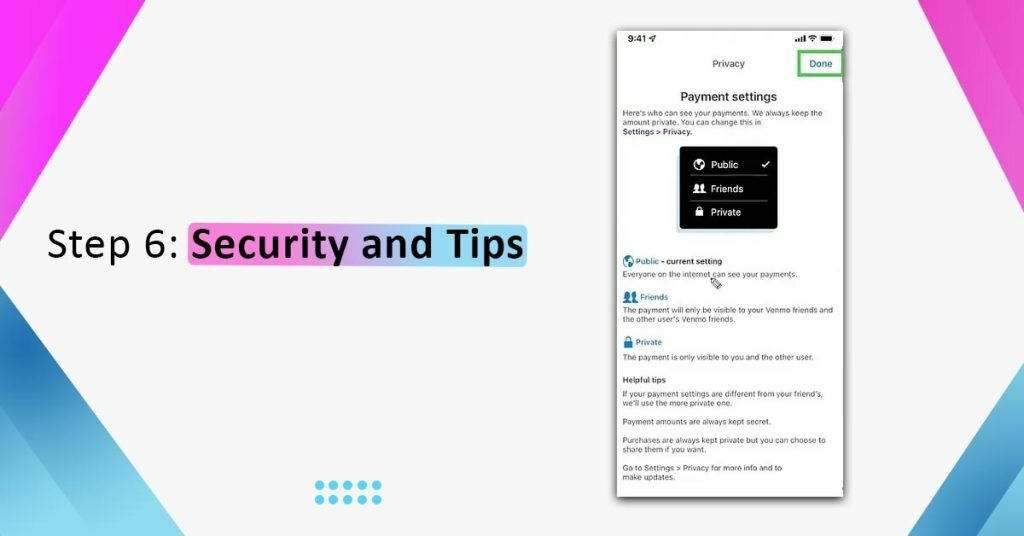

Step 6: Security and Tips

- To ensure a secure experience, protect your Venmo account with a strong, unique password and enable two-factor authentication if available.

- Only link accounts and cards from trusted sources, and regularly review your connected payment methods.

- Always double-check recipient information before finalising any transfers to avoid mistakes.

That’s it! You’ve successfully transferred money from your Venmo account to your bank account. If you have any questions or need further assistance, feel free to reach out to Venmo customer support or consult their official website for the latest instructions and updates.

Here Are Some Key Features of Venmo

- Payment Transactions: Users can link their bank accounts, credit cards, or debit cards to their Venmo account. They can then send money to other Venmo users by simply entering the recipient’s username, phone number, or email address.

- Social Feed: Venmo includes a social component where users can share their transactions and interact with friends. Users often include descriptions or emojis to indicate the purpose of the transaction, adding a social element to financial exchanges.

- Mobile App: Venmo is primarily a mobile app available for iOS and Android devices, making it easy to use on the go.

- Security: Venmo takes security seriously, offering features like two-factor authentication and encryption to protect users’ financial information.

- Transactions and Fees: Sending and receiving money through Venmo from a linked bank account is typically free. However, using a credit card for transactions may incur a small fee. Venmo also offers the option for instant transfers to a bank account for a fee.

- Business Accounts: Venmo provides business accounts, allowing companies to accept payments from customers, particularly useful for small businesses.

- Integration With PayPal: Users can transfer money between their Venmo balance and their PayPal account, offering greater flexibility for those who use both services.

Venmo has become a widely used digital wallet for everyday financial transactions, particularly among younger users and those looking for a convenient way to split expenses and share payments in a social manner.

Frequently Asked Question (FAQ):-

Venmo takes security seriously and offers features like two-factor authentication and encryption to protect users’ financial information. It is operated by PayPal, a trusted payment service.

Yes, Venmo offers business accounts, allowing companies to accept payments from customers. It’s particularly useful for small businesses.

If you make an incorrect transaction on Venmo, you can request a refund from the recipient. However, it’s essential to communicate with them to resolve the issue.

Yes, you can transfer money between your Venmo balance and your PayPal account, making it convenient if you use both services.